For people still working but unsure how to plan financially

Your retirement might feel far away, but the truth is, the earlier you prepare, the better off you’ll be financially.

Whether you’re decades away or just a few years from retiring, these ten steps can help you take control.

Many working adults, especially baby boomers and Gen Xers, are unsure of how much money they need or where to even begin.

This guide is full of practical advice to get you on the right path.

1. Create a Realistic Retirement Plan

The first step toward retirement success is creating a detailed retirement plan. Think about what your retirement dreams look like. Do you want to travel, volunteer, or enjoy more free time at home?

Understanding your desired lifestyle helps estimate how much retirement income you’ll need.

Factor in living expenses, medical costs, and any plans for part-time work.

Use online calculators or work with a financial advisor to get a rough idea of how many years your savings should cover. Your plan should also include retirement goals like your full retirement age and whether you’ll rely on an employer’s pension or personal retirement accounts.

2. Maximize Retirement Savings Early

One of the biggest mistakes people make is waiting too long to start saving. If you’re working full-time, now is a good time to boost your retirement savings.

Aim to contribute to a 401(k), traditional IRA, or Roth IRA consistently. If you’re over 50, take advantage of catch-up contributions to add more.

The more you contribute now, the more you benefit from compound interest. Don’t forget to look at your employer’s matching contributions—it’s essentially free money.

Review your retirement accounts regularly to make sure your investment strategy still aligns with your risk tolerance and number of years left until retirement.

3. Understand Social Security Benefits

Social Security will likely play a big role in your retirement income. But don’t rely on it as your only source.

Learn how the Social Security Administration calculates your benefits.

The longer you wait to claim (up to age 70), the larger your monthly benefit.

Check your personal account on the Social Security website to review your earnings history and projected benefits. Understanding how your years of previous employment impact your future payout can help you decide the best age to retire.

You should also know the tax implications of receiving social security benefits if you continue part-time work.

4. Meet With a Financial Advisor

Even if you feel confident, speaking with a financial expert can make a big difference. A certified financial planner or investment advisor can help you build a personalized plan. They’ll look at your financial needs, tax benefits, and asset allocation.

Don’t wait until your later years. A financial advisor can help you reduce financial stress now and make smarter investment decisions. Ask about advisory services that include retirement income planning, insurance products, and estate plans.

Legal advice is important too, especially if you’re considering a life insurance policy or creating a will.

5. Diversify Investment Strategies

If you’re still relying on a savings account or one mutual fund, it’s time to think bigger. A diverse investment portfolio balances risk and return. Look into mutual funds, ETFs, and tax-sheltered savings accounts.

Your investment strategy should match your risk tolerance and years to retirement. If you’re younger, you can afford to take more risk. If you’re closer to your golden years, shift to lower-risk assets.

Talk to your financial advisor or investment advisor about rebalancing your portfolio annually to match your changing goals.

6. Plan for Health Insurance and Long-Term Care

Healthcare costs rise with age, and many retirees underestimate these expenses. Start researching health insurance options, including Medicare and supplemental plans.

Medical insurance and long-term care insurance are two important things to think about now, not later.

Consider opening a Health Savings Account (HSA) if you’re eligible. HSAs provide great tax benefits and can be used for qualified medical expenses in retirement.

Your standard of living depends in part on your ability to afford quality care, so don’t skip this step.

7. Pay Off High-Interest Debt

Debt can follow you into retirement if you’re not careful. Credit cards, personal loans, and high-interest debt should be paid off as quickly as possible.

The goal is to enter retirement with as few monthly payments as possible.

Reducing your debt load improves your cash reserves and financial security.

Make a plan to pay off debt in stages, starting with the highest interest rates. The less debt you have, the more flexibility you’ll have with your retirement income.

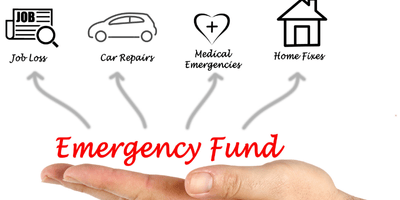

8. Build and Emergency Fund

Emergencies don’t stop just because you retire.

An emergency fund should be a high priority, even during your working years. Aim to set aside 3-6 months of living expenses in a separate, accessible account.

Cash reserves protect you from dipping into your retirement savings or credit cards.

Having an emergency fund gives you peace of mind and helps keep your long-term goals intact when life throws curveballs.

9. Update Your Estate Plan and Legal Documents

Many people overlook estate planning, but it plays an important role in your financial future. An updated estate plan ensures your wishes are followed and can reduce stress on your family members.

Work with a legal advisor to create or review your will, power of attorney, and healthcare directives.

A financial advisor can also help with the structure of your individual retirement accounts or any trusts you may want to set up.

10. Reevaluate Your Lifestyle and Retirement Budget

Now is the time to honestly evaluate your retirement budget.

Take a holistic approach and ask yourself what your actual expenses will be, not just what you hope they are. Review things like living expenses, medical costs, insurance products, and the potential for part-time job income.

Start tracking your spending now to get a clearer picture. Your retirement budget may need to adjust based on interest rates, tax rates, or changes in your financial situation.

If possible, try living on your projected retirement income for a few months to test it.

It’s Never Too Early (or Too Late)

Preparing for retirement is one of the most important decisions you’ll ever make. It doesn’t have to be overwhelming. By taking small, consistent steps, you can head in the right direction and build confidence in your financial planning.

Whether you’re just getting started or reevaluating an existing plan, remember this: the best retirement plan is one you understand and stick with.

Explore different ways to save, invest, and protect your future.

And if you’re not sure where to begin? Start by speaking with a financial advisor, reviewing your retirement accounts, and writing down your retirement goals.

Your golden years are worth the effort today.

This content is for educational purposes only and not intended as professional financial or legal advice. Always consult with a certified financial planner, tax advisor, or legal professional for your specific situation.

Brought to you by Get Inspired by Cathy. Thank you for reading. Please follow me on Facebook and Pinterest where you can explore my Home Decor, Party/Event Planning, Weddings, Proposals, Beauty/Fashion, Human Interest (my fav), etc. Once again, thank you for reading and good luck with your retirement plans

More to read:

Dealing with Grief Journal

Dealing with Grief Journal